EARLY 1980s

Investment Center, Inc. (DBA Ogrizovich Financial Management) was registered with the Securities and Exchange Commission in 1981. Ultra high inflation (~13%) and short term interest rates (15%+) characterized the economy and made the introduction of financial planning, as a new service, very challenging.

LATER 1980s

The practice and identity of financial planning started to get recognized as tax reform, emergence of 401(k)s, a volatile stock market (e.g. crash of ’87), and demographics (i.e. Baby Boomers) impacted financial decision making. Sam and Jane became pioneer CFP® Professionals. Jane joined the company.

THE NINETIES

Economic expansion fueled by growth in technology, globalization, and baby boomer spending. The profession of financial planning gains traction and recognition. Ogrizovich Financial Management moves from Olympia Fields IL, to Orland Park, IL. Sam writes financial column and teaches as adjunct professor and instructor in preparation for the CFP® Exam.

EARLY TO MID 2000s

The Dot Com Bubble burst resulted in a 2 ½ year stock market decline — the worst since the Great Depression. We weathered the storm with our loyal clients. Our investment management discipline was tested both before the bubble burst (offsetting greed) and after (controlling fear)

LATE 2000s

Financial Crisis of 2007-2009 rocks the global markets as 401(k)s become “201(k)s”. Investors experience the “new” worst market decline since the Great Depression. Once again, our loyal clients weather another storm, maintain our discipline and anticipate recovery. Financial Planning (investment management, tax, estate, education, and retirement planning), as opposed to investment product sales, prevails in a complex, volatile financial climate.

2009 – CURRENT

Ogrizovich Financial Management Inc. changes its name to OFM Wealth to reflect the depth and capabilities of our wealth managers. OFM Wealth has grown from its infancy in the 1980’s to a mature enterprise that has trained nearly 50 student interns, employs a wonderful team of bright, caring, and hardworking professionals, and has been home to two grateful owners. It has been, and I’m sure it will continue to be, a great journey.

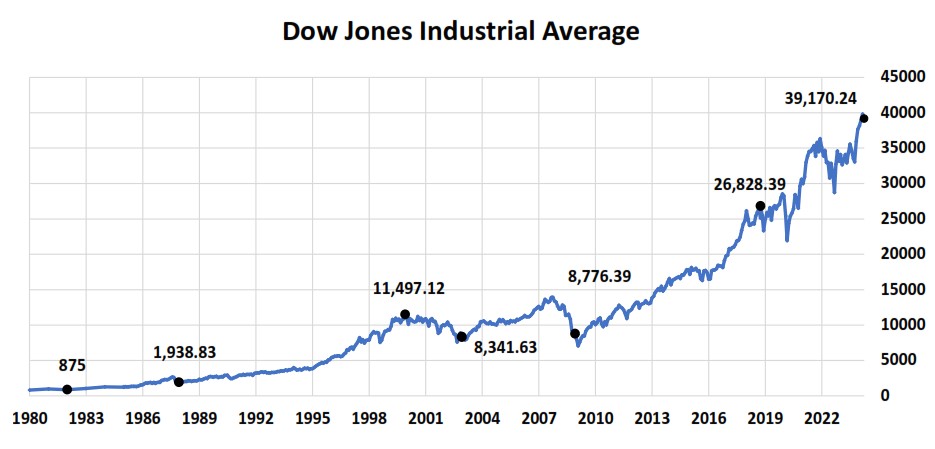

DOW JONES INDUSTRIAL AVERAGE

Yes, that’s growth from 875 to 39,170.24 since the end of 1981.

More importantly, however, our clients’ wealth was built and maintained, sustainable retirements were realized, and many assets have been transferred to new generations.

Source: Yahoo Finance